Ryno Company Chico Investment & Multi-family Property

Take a look around and find your next Chico income property. Whether it's a duplex, triplex or large apartment building, let us help you evaluate your return and increase your cash flow. We are successful investors and property managers also, so you are in good hands.

We specialize in Residential Income Properties in Chico

Start Browsing

Jump right in and see whats currently on the market.

Sell With Us

Want or need to sell your investment property?

Search Current Listings

Use our advanced tools to search current investment properties on the market

Recently Listed Investment Properties

$1,595,000

1500 Sheridan Avenue

- 5,870 Sq.Ft.

- 1 Buildings

- 8 Units

- CITY Zoning

- 0.26 Acres

Chico, CA 95926

Residential Income

$1,195,000

728 W Sacramento Avenue

- 5,828 Sq.Ft.

- 1 Buildings

- 5 Units

- CITY Zoning

- 0.23 Acres

Chico, CA 95926

Residential Income

$980,000

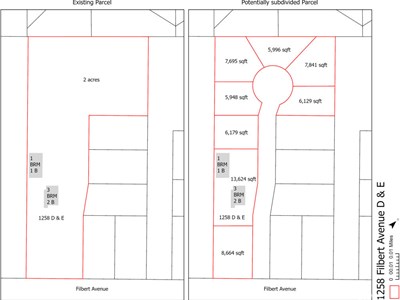

1258 Filbert Avenue

- 2,330 Sq.Ft.

- 2 Buildings

- 2 Units

- R1 Zoning

- 1.87 Acres

Chico, CA 95926

Residential Income

$639,000

1131 W 6th Street

- 2,200 Sq.Ft.

- 2 Buildings

- 2 Units

- R3 Zoning

- 0.26 Acres

Chico, CA 95928

Residential Income

$499,000

2465 Pillsbury Road

- 2,915 Sq.Ft.

- 1 Buildings

- 2 Units

- R2 Zoning

- 0.40 Acres

Chico, CA 95926

Residential Income

Active Under Contract

$499,000

1109 Ivy Street

- 1,544 Sq.Ft.

- 1 Buildings

- 2 Units

- R3 Zoning

- 0.13 Acres

Chico, CA 95928

Residential Income

Ryno Company, CalBRE #01859198 | 242 Broadway Suite 12, Chico CA 95928

530-343-2959

© Ryno Company 2016. All Rights Reserved.